Provider of innovative analytical, processing, and management tools in financial markets for smarter decision-making, efficient capital management, and achieving maximum returns

Provider of innovative analytical, processing, and management tools in financial markets for smarter decision-making, efficient capital management, and achieving maximum returns.

Best performance

Bringing the best performance to its users in the capital market, by providing products based on analyzed financial data

Analysis and presentation of Data

Providing analyzed data for better investment decision making

Data collection and processing

Collecting and processing various financial, economic and commercial data available in the Iranian market for investors, researchers and other users.

Providing a range of services such as Neo Bank, bill payment, etc.

Risk assessment of fixed income funds with customization capabilities

Review of the portfolio of Namad Ghadir Financial Group and its subsidiaries

Conducting fund operations and assisting in providing investor services

Instant buying and selling of issued and cancelled funds and ETFs

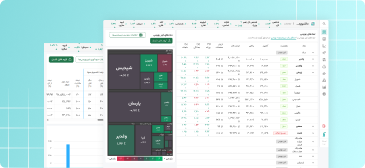

Monitoring subsidiary stocks in the live market, evaluating analysis parameters, etc.

Budgeting with capabilities at the company and holding level

Ghadir Symbol Financial Group, together with Rahbar Informatics Services Holding, established Aras Financial Information Processing Company as the FinTech arm of Ghadir Investment Group, and this company was registered in March 1402 under the supervision of the Securities and Exchange Organization with the Tehran Companies and Non-Commercial Institutions Registration Office. The company’s areas of activity include developing the infrastructure required by the capital market, developing dashboards and platforms for presenting and analyzing data, and developing products in the field of asset management based on data processing and artificial intelligence.

Among the company’s future products, the development of which is currently underway, is a software system required by brokerage companies, capital raising companies, investment funds, and portfolio managers.

Today, data science and artificial intelligence are rapidly advancing their position in financial markets. The company has formed a team of elites in the fields of data processing and artificial intelligence and has begun developing products in this field.

One of the company’s main services in the near future will be the development of comprehensive systems for presenting and analyzing capital market data to institutional and retail clients. The target audience for these products can be fund managers, portfolio managers, etc.